Hello and welcome to Episode 26 of What China Wants, looking at the struggle between China and the US/West for control over the world’s most important component: microchips.

Stewart and Sam are joined by Chris Miller, the author of Chip War: The Fight for the World's Most Critical Technology, which was shortlisted by the FT as its business book of the year 2022.

Some highlights from our discussion:

Microchips are central to both the world economy and modern militaries, and so both China and the US want to control them.

Unfortunately for China, the US has more control over the semiconductor industry than they do, and so the ban on advanced chip exports that Washington just placed on Beijing is going to hurt the latter more.

Given the source of the machinery and equipment needed to make the world’s most advanced chips (US, Netherlands, Japan), it’s basically impossible for China to make advanced chips if the US cuts it off. Which it has.

There is a fear that the senior Chinese leadership aren’t fully aware that their country doesn’t have the autarkic capability of making advanced chips.

China is going to struggle to achieve its high level technology goals without these chips, which will have an impact on the economy and the country’s comparative international tech prowess.

Will China push back on the US over the ban? They didn’t when Huawei was targeted, so may not feel strong enough yet to do so.

We note that 90% of chips are still available to China, so whilst advanced tech like AI will be more of a challenge, “standard” digital infrastructure projects will still be possible.

Whoever controls the most advanced chips, and therefore the most advanced computing power, will have a major advantage in terms of converting that into military power.

You can also listen to the podcast on Apple, Amazon, or Spotify.

As always please do share, comment, and subscribe. We’ll be back soon with more What China Wants.

Many thanks for listening.

***

Here is the transcript:

Sam Olsen: "Last year, the chip industry produced more transistors than the combined quantity of all goods produced by all other companies in all other industries in all of human history. Nothing else comes close." Hello, and welcome back to What China Wants with Sam Olsen and Stewart Paterson. Stewart that was a quote from an excellent new book called Chip War, which discusses how microchips have become so central to not only the world economy, but modern life as we know it. This of course means that the control of who produces them becomes incredibly important geopolitically and geoeconomically.

It is no wonder therefore, that chips have become a key point of contention between China and the West, and not just because Taiwan - that renegade province, 100 miles off China's coast - is home to the majority of worldwide chip production. Here to join Stewart and I today is the author of that book, Chris Miller. Now, Chris, you teach international history at Fletcher School at Tufts University, if I'm right?

Chris Miller: That is correct.

SO: And you have had a lot of accolades for your new book Chip War, including, I think a recommendation by the FT as one of the business books of the year, is that right?

CM: That's correct, yes.

SO: Okay, great. Well, it is quite an important subject, and welcome along to help us talk about it. You might have heard Stewart and I discuss microchips quite a lot in previous podcasts, but obviously, having an expert like you is a bit more fun for the listener rather than just hearing us to talk about things. But I suppose the most important thing for those who have not really listened to us talk about chips before is why are they so crucial? What is the importance of chips globally?

CM: Well, the typical person rarely sees a semiconductor but in fact, we're reliant on them for almost all aspects of daily life from your automobile, which might have dozens or hundreds of semiconductors inside, to your smartphone or PC, modern life cannot work without them. The production of chips is controlled by a small number of companies and a small number of countries, and increasingly, for the first time in several decades, the chip industry is being upended not only by the competition between companies for commercial advantage, but also by competition between countries for geopolitical advantage. At the centre of this competition is US-China rivalry for greater influence over the production of advanced semiconductors.

Stewart Paterson: So Chris, some of our listeners will have heard in recent weeks of the Biden administration's embargo on certain types of chips being exported to China. Some of them might have also seen that this does not just extend to chips that have been manufactured in the United States, but it extends to third countries who use American-derived technology, either in the manufacture of semiconductor manufacturing equipment, or in the chips themselves. So perhaps this would be a good opportunity for you to explain to our listeners, the differentiation between chips, because obviously they are not all fungible, and to tell us what the purpose of this embargo is.

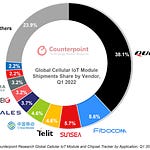

CM: The goal of the recent export control moves is twofold. First, to prevent China from accessing the types of chips needed for high performance computing and AI applications in data centres, and second, to prevent China from producing some of the most advanced chips domestically. Today, China spends about as much money importing chips each year as it does importing oil. So, it is hugely dependent on the import of advanced chips from Taiwan, from Korea, from Japan, and from the United States. It has identified this is a major vulnerability that has been trying to address over the past decade with many billions of dollars of government subsidies.

But the leaders in chipmaking are Taiwan, South Korea and the United States, and today, it's basically impossible to produce not only the most advanced chips, but any sort of fairly cutting-edge shipped without using equipment from five companies across the world - three in California, one in the Netherlands, one in Japan - and it is impossible to design an advanced chip without using software from three companies, all of which are based in United States. So you need to access US as well as Japanese and Dutch technology to make an advanced semiconductor regardless of where you are in the world. That means that when the US cuts off China's ability to access this machinery as it's done with its export controls in October, China simply cannot produce anything close to cutting edge chips. Similarly, because Taiwanese producers or South Korean producers are equally reliant on many of the same tools they have to follow US export controls, as well. So the US has made clear that no one in the world can produce certain types of advanced chips and then transfer them to China.

SO: So in the book, you talk about the fact that China's not pursuing an all-domestic supply chain, or chip supply chain as that would be impossible. But where do you think China is going instead? If chips are vitally important to the Chinese economy and also to their exports, etc, surely then being cut off from American chip expertise and Western chip expertise more broadly means that they are incredibly vulnerable, so where do they go from here?

CM: I think the Chinese government has faced a bit of a dilemma created by its own policymaking process in the semiconductor space. If you talk to people in the Chinese semiconductor industry, they will readily admit that self-sufficiency or even a de-Americanized supply chain is a very, very long way away for China when it comes to advanced semiconductors. But it is not clear that that information has made it up all the way to the top of the Chinese government, or if it has, it has been pretty heavily discounted because the Chinese government has been pursuing an industrial policy at home in the chip space, as well as a foreign policy abroad, that has been in some ways perfectly calibrated to trigger exactly these types of export controls from the United States.

And so today, the Chinese chip industry finds itself in a really difficult situation, it is only really feasible to move up the technological production process and move up the value chain by importing technology from the US and allied countries, but it's getting more and more difficult to do that because of Chinese industrial policy at home and in foreign policy abroad. I think if you had to assess Chinese policy in this space for the past decade, you would not give it that high of a mark, because they put themselves in such a complicated and difficult situation.

SO: It's all very well noted about China's supply chain issues with the government and so on, but to what degree can China fulfil its economic goals - its quite ambitious technology goals such as wanting to be the leader in AI, in automotive vehicles, etc - without those microchips and without that Western microchip expertise? What would you suggest are China's options now in terms of fulfilling its five year technology goals?

CM: Well, I would say first off when it comes to AI, phrases, like 'leader in AI' are, are phrases that political leaders like but are hard to assess in practice. So I think we should we should treat all political goals in China or in other countries in that sphere with some amount of scepticism, just because it is not clear what they mean. But I think what is clear is that if you ask why, in any country, there is a lot more application of artificial intelligence today than 10 years ago, it's not primarily because we have smarter algorithms that no doubt, we've got better algorithms today than a decade ago. It's not primarily because we have more data available, though perhaps we do in certain situations. The key differentiating factor is that compared to 10 years ago, chips are many times more effective than they were a decade ago, and that's because for the past 50 years, Moore's Law has meant an exponential growth in processing power on chips and doubling in computing power.

Computer programmers' intelligence hasn't doubled in the last decade, but processing power provided by chips has, and that's why we are seeing AI applied to so many different parts of the economy today, relative to the past. What that means for China, is that if it's unable to access the most advanced chips for AI purposes and data centres, it is going to face real difficulties compared to every other country in the world in further advances in this sphere, because the cost of running AI and data centres, which is the number of chips you need multiplied by the energy consumption of those chips, is going to become much more expensive relative to in any other country.

SP: Chris, can I just ask here, and you mentioned a couple of times now, the word 'allies' when you were talking about the export controls. Clearly the chip industry spans across nations, although there are a select few that are at the leading edge. Is your sense that the Biden administration has been a little disappointed by the lack of sort of voluntary buy-in by the likes of the Dutch government with regard to ASML, and potentially even with the Taiwanese and the South Koreans, in terms of their slight reluctance and sort of push back against the export controls that they have tried to put in. Perhaps you could try and quantify for us how important that Chinese market is for these companies, because although we all know that China is a huge importer of semiconductors, presumably a lot of these are actually very low-end semiconductors that go into assembly for all the electronic goods that China then re-exports. so not actually for the Chinese domestic market, they are just a part of the sort of supply chain.

CM: Yes, that is right, and I think the key question for looking at the efficacy of export controls is the machine tools that are needed to produce semiconductors. These are the most precise and expensive machine tools humans have ever created, and their production is controlled by a really small oligopoly of companies, most of which have been in their market positions for decades, and in some cases, almost half a century. The two countries that matter besides the United States in the sphere are really Japan and the Netherlands. The Koreans and the Taiwanese produce a lot of chips, but they have produced chips using mostly imported machine tools from the Netherlands, Japan, and the United States.

When it comes to multi-lateralization of export controls, which is what the US wants, I think there are a couple of dynamics at play. The first is that every country besides the US has a very strong incentive to publicly demur about export controls, so they can tell the Chinese that they are being forced into it. That's a very rational strategy, I think the US government expected that to some extent. So if you look at how the Netherlands has approached export controls on EUV lithography machines, the most advanced equipment, they have created a situation in which the headlines in international media are 'US government forces Netherlands to impose export controls', whether that is a completely accurate description or there was more Dutch initiative than the headline suggests, I think there is room for debate and discussion. But if you're the Netherlands, that's a great headline to have, because then you can go to the Chinese and apologise about your overbearing American partners.

I think the Japanese have a similar dynamic that's partly at play. Now, there's obviously in both of these countries debate between the policymaking process, the National Security bureaucracy, and the companies themselves. But I think when you zoom out and look at the debate in the Netherlands and the debate in Japan, about China and technology, what you will find is a pretty similar trajectory to the shift in the US view over the past decade. In Japan in particular, I think the median view is of anything more hawkish on Chinese tact than in the US government; less open, less public about many of these issues, but actually more hawkish in practice.

So the key question from the perspective of efficacy of export controls is not 'what's the media headline', or 'what's the formal policy', but it's 'what's actually happening on the ground?'. So I think we'll have to see over the next couple of years, is there meaningful leakage in the US export controls via allied countries or not? If to the extent that there is leakage, I think we should expect the US to turn the screws even tighter. But that might also be a reason to expect that those two governments might, on their own, take measures to make sure that leakage is controlled to a certain extent, and does not attract the attention of the US Congress or US regulators.

SO: If you look at the chip export ban, then you might think that China is going to suffer quite a lot. But at some point, surely, China is going to be saying, we need to push back on America - although that said, when America pushed the ban on Huawei China did not seem to do much. You say in your book, that Beijing was happy to let Huawei become a second rate tech player rather then push back on America. First of all, what happened to Huawei? And secondly, why didn't China push back? And I suppose after that is will that set the pattern for what China's going to do in the future?

CM: Yes, so with Huawei, the US prevented any company that uses US technology from producing certain types of advanced chips for Huawei, without a licence from the Commerce Department. That meant in practice that Huawei could not turn to TSMC, the biggest Taiwanese chip maker, and have that company produce chips that Huawei designs. That had a major impact on Huawei smartphones, on Huawei's telecoms equipment business, and Huawei's cloud computing business and has forced a huge set of changes for the company and major losses over the past couple of years. As you say Sam, China did basically nothing in response. It created a regulation by which it could punish foreign companies, but then put no foreign companies on that list, so has not retaliated. The reason is that retaliation, the Chinese leadership concluded, would be more costly than the not retaliating.

I think that has created an interesting precedent for the current export controls, we will have to see whether China responds. Certainly the recent round of controls are even harsher than the controls on Huawei. But if I had to guess right now, I would guess that that provides a pretty good template for understanding what China is likely to do in response to this round of controls as well, because the optimal response from China's perspective is to do something that hurts the US more than hurts China. The number of potential responses on that list is actually I think, quite low.

SO: Okay, so this is where I have got a slight problem, not with what you're saying, but with the logic that supports your argument. Again, you state it very well, but I think that there is a gap in the logic, which is that China is not going to do anything, even though we know that China has set in store its dominance, however you define that politically or economically, of certain industries, and it's telling its people that it will be a world leader and the technology of the future will be China's. So if that's what it's telling its people, but it's not going to be able to achieve that because America is putting export controls on, is the gap, therefore, something that China can bridge and, and perhaps, will bridge by doing something more conflict-y with America, either over Taiwan or directly with America or something like that? At the moment, I am struggling to see how they can square the circle of their stated tech ambitions with what America is doing?

CM: Well, I think there is uncertainty both in my analysis, but also in China's analysis as to what China's capabilities will be over the next decade. I think in my view, and I think there is a consensus in the chip industry, that China is going to face real difficulties in domesticating a lot of these machine tool technologies needed to produce semiconductors, but there is no certainty there. My guess is that Chinese leaders are getting rosier predictions than I'm giving you about China's capabilities. That makes sense, because when China's leaders go to domestic machine tool firms say, 'will you be capable of solving this national task over the next five or 10 years, if we give you vast sums of money?', it is easy to imagine CEOs of those companies saying, 'of course, we'll be able to achieve these national tasks', regardless of their actual level of confidence. So I suspect that actually Chinese leaders are more confident than I am in China's ability to reach these goals, which is why they might think it is in their interest to wait and see.

SP: Chris, if we look at the evolution of the geo-economic pushback from the United States against China, we started with the Trump tariffs, which seemed to arguably induce the phase one trade deal, which was highly transactional and obviously, the Chinese have not delivered on any of that. Then we had some export controls, didn't we, which drove ZTE (a Chinese tech firm) potentially into the ground, but then Trump seemed to actually just let them off the hook at the last minute. You would know more about that than I and correct me if I'm wrong.

But then these export controls, the way you are describing the impact, they seem to me to mark a profound shift in America's approach in the sense that they seem (a) very targeted, (b) aimed really at containment of China. This is the first policy we have seen, I think, that to the outside observer does seem to be aimed at pulling the rug from under China's feet, rather than what might be termed 'equilibrating pushback' to compensate for the asymmetry of trade relations and economics exchanged in the past. Would you interpret this as a new front with a new objective, and the beginnings of a much more succinct and targeted approach to China-US rivalry?

CM: So I think if you look at the past five or 10 years of US approaches in this issue, you have got to differentiate Trump and the tariffs, which were driven by the President from the much broader tech focus, which was driven by the bureaucracy, driven by the intelligence agencies driven by the defence department driven by the National Security Council from the late Obama administration, all the way up to the Biden administration. Those are, I think, really two separate tracks, I think you can find instances where President Trump got involved in issues and there was back and forth like the tariffs that you mentioned, but if you chart semiconductor regulations, you will find almost exclusive tightening over time, and you'll find that they are driven largely by the bureaucracy.

I think what we have seen over the past month in US regulations is the culmination of a lot of the prior steps, that has got bi-partisan backing and backing across the US government bureaucracy. So I think we should interpret these as staying in place for a long time. And I think you're right, Stewart, that they do signal a more zero-sum approach to tech competition than in the past. I think that is a recognition on the US side that there is a zero-sum approach to military power, pursued both by Beijing and by Washington, and that semiconductors are going to be crucial, well they already are but will increasingly be crucial to next generation military systems. And if the US is going to keep its military edge in the Taiwan Straits and the Western Pacific more generally, it has got to have a major edge in computing power so we can apply that computology to military systems.

This is not really, I don't think, about the same thing that Trump's tariffs were about, which was about economic issues and jobs and commercial success. This is very much about who has got the computing power to apply to cybersecurity, to intelligence collection and to military systems. That's something that the US has historically had a major advantage in. China has closed that gap, and as China has closed that gap, it has coincided with a vast expansion of China's military in the western Pacific. The US has more need than ever before, to have a big gap in computing power, because it is facing a big gap in quantitative terms, it has got fewer chips, fewer missiles, fewer drones, than the Chinese and will have even fewer in 10 years time. So it needs a lot more transistors, to put it very crudely, to make up for the fact that the Chinese are going to have a lot more military systems in the western Pacific.

SO: Okay, so what is all this going to do to Chinese influence, for example, through digital infrastructure building, which it has accrued lots of influence through? Do you think that the days of the Chinese using the Digital Silk Road to amass influence globally are beginning to wane? I cannot see how China's going to be able to do all the fancy-dancy systems, if it has not got access to the chips.

CM: I think that it will face growing difficulties. Now, it is still the case that the US has only cut off China's access to a very, very small portion of the chips that it currently buys. I haven't seen great estimates quantitatively, but a couple percentage points of the chips that China normally buys will be cut off, 90-something percent will still be available to China. This isn't a cliff edge in terms of China's technology. This is the US trying to say 'we're going to stop China's advances on high performance data centres going forward'. And so over time, if the US export controls work, there will be a growing gap in data centres between what is possible in China and what is possible the rest of the world. So that will have an impact on digital Silk Road efforts over time, but it is not going to be a dramatic deceleration over the course of a year or two.

SO: This has been really interesting for our listeners I think to hear a bit more about the specifics of the chip industry. But your title is 'Chip War', do you think that this is actually stimulating a war over chips as in a kinetic war? Do you think this is going to be something which is kept to the economic arena moving forward?

CM: Well, I certainly hope that this does not stimulate a war, but I think we should be highly cognizant of the fact that in all major powers, semiconductors are thought of, largely due to their importance in defence systems. The first chips emerged for missile guidance computers in the early Cold War. And today, if you think of what it takes to fly an advanced drone, you need a tonne of processing power, lots of chips to manage all the sensors, radar, infrared, LiDAR, etc. All that requires immense digital signals processing, it is all about semiconductors.

So you cannot understand the semiconductor space today, or the role that governments are playing trying to reshape semiconductor supply chains, unless you understand their importance for military systems. In that sense, I think 'chip war' is the right way to look at it, not that it is going to cause a war, but that it will be crucial to the future of warfare, and whoever controls the most advanced computing power will have a major advantage in terms of converting that into military power.

SO: Okay, so last question, does that mean that if China takes over Taiwan, that means that we in the West get cut off from Taiwanese chips, we are basically unable to compete against the Chinese military?

CM: Well, I think there are a number of big jumps there. First of all, if China takes over Taiwan with a war, it is unlikely that Taiwanese facilities will survive a war. So that is step one. If China manages somehow to assert control over Taiwan without a war, that will be a very different and more dangerous situation. There is then a process of applying semiconductors to military systems, which is something that takes a fair amount of time to do. But yes, I think we should be concerned that if China succeeds in domesticating, more advanced chip technology or acquiring from elsewhere, that will feed into the military systems over time, and we have got plenty of evidence for how that already has fed into Chinese military systems over the past decade or two. We have got great open-source evidence of China using US chip technology and military systems, and so I think it's understandable that the Pentagon is saying 'we're facing more pressure than ever to defend our allies and partners in the Indo-Pacific region, from chips that are powering Chinese military systems. We've got to find a way to change this.'

SO: Great, thanks very much Chris Miller. Chip War is out now, go and buy it and learn a bit more about what could be the precipice we are about to fall into. Thank you very much.

CM: Thanks for having me.

Episode 26: China-Western Chip Wars