Hello and welcome to Episode 18 of the What China Wants podcast.

Long term readers might recall an earlier newsletter on WCW discussing accusations concerning the theft by China of Western intellectual property. Today we return to this topic with an interview with the academic Luke Patey, who has written extensively on the challenge faced by Europe’s tech companies as they try to compete with Chinese firms.

Some highlights from our discussion:

New technologies, like those in renewable energy and telecoms, are vital for national economies but European firms in these sectors are struggling against their Chinese rivals.

The negative impact of Chinese firms on European tech is probably a result of massive internal investment by Beijing that creates national champions with the scale to beat the global competition; hints that European tech companies are being deliberately targeted by mercantilist policies are hard to prove.

European tech firms, especially in the 5G space, actually have a worldwide lead over their Chinese rivals apart from in Asia.

European governments need to understand the importance of the whole tech value chain, not just large companies, and support industries rather than just one or two giants.

You can also listen to the podcast on Apple, Amazon, or Spotify.

Here are some of Luke’s recent articles:

As always please do share, comment, and subscribe. We’ll be back next week with more What China Wants.

Many thanks for listening.

***

Here is the transcript:

Sam Olsen: "The documents began arriving in China at 8:48am on a Saturday in April 2004. There were close to 800 of them: PowerPoint presentations from customer meetings, an analysis of a recent sales loss, design details for an American communications network. Others were technical, including source code that represented some of the most sensitive information owned by the Canadian tech giant Nortel, then one of the world's largest companies. "The hackers were taking the whole contents of a folder - it was like a vacuum cleaner approach," says Brian Shields, who was then a senior adviser on systems security and part of the team that investigated the breach. Years later, Shields would look at the hack, and Nortel's failure to adequately respond to it, as the beginning of the end of the company. By 2009. Nortel was bankrupt."

Welcome back to What China Wants with me, Sam Olsen, and Stewart Paterson. That Stewart was an excerpt from an excellent article by Natalie Obiko Pearson in Bloomberg from a few years ago, detailing the reported hack of Nortel by persons from China, and apparently from Huawei, according to the accusations. But as you know, this is not the only accusation about China's aggressive moves against Western tech firms. Although to be clear, it is not just about hacking - there are lots of ways that China plays hard with Western Tech.

And today, we are going to ask the question, is China destroying Europe's technology companies in fair ways or foul? To help answer that we've got a very good expert on this topic, someone that has appeared on What China Wants before, Luke Patey. So Luke, welcome along.

Luke Patey: Thanks so much, Sam and Stewart, it's great to be here.

SO: And for those of you who remember, Luke wrote that seminal book from a few years ago, How China Loses, which obviously, generated a fair number of headlines around the world. It is fair to say that that did cause a bit of a stir in some sectors, right Luke?

LP: Sure, I think it had a variety of reactions, but I hope it helped to sort of nuance the picture that China's outside relations have been upset by Beijing's foreign policy in recent years and beyond just with DC but also other foreign capitals.

SO: And now you have turned your attention to looking more at the competitive environment between Europe and China regarding tech. But what do you mean by tech - which areas you covering, which areas do you think at most at risk from sort of issues around China and Chinese competition?

LP: Well, I am trying to take the view from Europe and to look at China's evolving economic and tech relationship with Europe and the European Union. What I think is particularly interesting when it comes to Europe is that Europe stands out as a leader in mobile network technologies, the Ericsson and Nokia's of the world that compete with Huawei, as well as in wind power, Vestas, Siemens Gamesa, and those Nordic and German companies that our driving wind power generation.

And I think there are two good reasons to focus on these technologies. First is that both mobile network technologies and wind power are going to play a pivotal role in geopolitics and industrial competition moving forward, not to mention the loftier aim of addressing global climate change. Mobile technologies, and the advent of fifth generation mobile networks, promise to give us the Internet of Things, enhance automated factories, lead to autonomous vehicles, smart cities, and drive far higher speeds, lower latencies, and larger frequency ranges in mobile communication. So the countries and companies at the head of that industry, at the head of that technology are going to really drive new competitiveness, and new welfare for their economies.

Wind power obviously serves a important purpose when it comes to addressing global climate change. It also serves a more immediate goal for Europeans in weaning off dependence on Russian energy. And so, the role of electricity generation and the role of wind power in generating that electricity needs to increase around five, six fold by 2050 to reach the Paris climate targets. But wind is also big business, we are talking hundreds of billions of dollars in new investments that need to go into that industry here in Europe and around the world to reach those goals. So, it has this importance for European welfare and European geopolitical clout as well.

Now, the second reason I think it's important to look at mobile network technologies and wind power technologies is that it brings a focus on European tech capabilities and interests, and it takes us away from a fixation on US-China competition. I think many of us following international politics are often really focused on whether the US or China is ahead in the global tech race, when in fact, it's often others – Europe, but also East Asian countries – that are at the head of particular technologies.

SO: Now, you are right, that's not actually commented about much in the world's press, partly because the world's press looks at America for all things technological, historically. But Stewart, I know you have done quite a lot of work looking at the relationship between America, Europe and China. Is this something that is perennially under-reported, the impact of Europe in international trade, not just technology?

Stewart Paterson: I think it is underreported, and I think, Luke, my opening question to you really would be in the America-China debate, the economics is often couched in terms of theory, and there's a strong moralist element to it as in the sense that China is perceived as having acted unfairly. I'm talking here purely in economic sense, not IP theft, through industrial subsidies, currency manipulation, etc. But obviously, Europe, continental Europe anyway, has a strong tradition of industrial policy of its own. The German industrial base was built post-war under the guidelines of a strong connection between the state and private sector companies. And obviously, France has a large number of state-owned companies that have dominated the commanding heights of the French economy for a while.

And so, is it fair to say that actually China's economic structure, which obviously is unique, but that it actually bears quite a close resemblance to some of continental European sort of economic structures? And that that's deliberate because the Chinese actually copied it? And therefore, are we really saying here, IP theft aside, that China has come to dominate a lot of these industries simply because it's cooled off a mercantilist approach to economics better than the continental Europeans?

LP: I agree with you that the Chinese didn't invent industrial policy, far from it. The Europeans have been engaged in it, and still are, the Americans as well, and the Japanese, of course. So I we need to, I think, recognise that our economies have been also getting support from the state over decades and centuries in the past. A recent report by an American think tank found that China has provided five times more state support than the US in recent years, and 21 times more support compared to Germany. So, the recent figures show that China is definitely pumping more money into its industries, and that is, in some cases, helping its industries to undercut the competition overseas. In some cases, it doesn't work out: semiconductors have taken a long time to do well for the Chinese and still hasn't, despite billions of dollars being pumped into that industry.

But when it comes to industries like telecoms, or wind, where it's about building scale, it's about process engineering and manufacturing a product, the Chinese definitely take that support that they get from the state to their advantage in overseas markets. And unlike I think, what we see in the US or the EU, Chinese companies have this sort of preferential domestic market where market shares for companies like Huawei, or in the wind industry, Goldwind, are guaranteed, that they know they will get a certain market share at home.

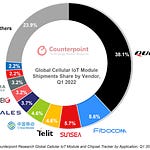

The Chinese market in telecoms or wind often might be half of the global market in any given year, so they can exploit that guaranteed market share and undercut rivals abroad, which erodes the competitiveness of their competitors in Europe and elsewhere over time, and allows them to therefore gradually build global market share – which we saw Huawei do quite dramatically in the last 15 years, with Huawei and ZTE, its Chinese counterpart, going from around 6% of the global market share in network equipment to 40% in recent years.

SP: So what you are really saying there, Luke, is that the way China is coming to dominate these industries is by having these national champions operate in effectively a closed market in China. This then gives them the scale that they need, they can perfect their products and then they take advantage of the asymmetric openness. So, we are open to them, but they are not open to us. And obviously, they then have this strong economy of scale advantage, which means that they can undercut foreign competition as they globalise.

LP: Sure. One way to look at it is this. For the telecom industry in Europe and the wind industry in Europe, our companies in Europe – Ericsson, Nokia, Vestas, Siemens Gamesa – they have single digit shares in the Chinese marketplace, sometimes low single digits, depending on the year. They do not have the political connections to get this preferential treatment from local procurement, where a lot of the business is being driven from.

But if you look at the market shares of these European companies in the United States, which is, of course, a much more open economy, these companies are leading in those industries. Ericsson has had tremendous growth in its revenues from the US, the US is by far its largest market, it's even bigger than what they generate within the entire EU by far. Vestas is often the leader in the US wind industry, even above the local competitor, GE. So we see that European companies are flourishing when there are open markets to compete in, and not doing so well in China where the chips are against them in terms of the comprehensive support that Chinese companies receive.

SO: So Rob Atkinson from the technology think tank ITF, has written widely around what he calls China's ‘innovation mercantilism’, in other words, trying to destroy the innovation base of rival countries. He explained there about how China uses its domestic market to build up champions, but there are also allegations of widespread IP theft – we mentioned the Nortel potential example at the beginning – but there are so many. For example, the German photovoltaic industry has long complained about hackers taking their IP, and in many other industries in Europe and America as well. The finger of suspicion is almost entirely pointed towards China. If that's true, that would fit into Rob's thesis around innovation mercantilism, in other words, steal their IP from companies, substitute and develop it more quickly than their European or American rivals, and then destroy the American and European companies by being cheaper.

To what extent do you believe that there is a deliberate policy of innovation mercantilism by the Chinese to destroy European technology? Or, do you think it is actually just a by-product of trying to create domestic champions, and because they are so well supported for doing things well at home, that they end up just by their very nature being able to destroy and undercut the competition abroad?

LP: I think it’s more the latter. I think it's part of this comprehensive package of behaviour that we see from Chinese industries, that the Chinese government has certainly not cracked down on when the Americans or the Europeans have pointed towards these IP thefts as a major problem for their industries. So I think it's hard to peg down intent on the Chinese side, but the Chinese government over the last decades has definitely not stood in the way of state and private actors engaging in IP theft.

The impact has been quite severe. I mean, the US government suggests that somewhere between USD 300 billion to USD 600 billion per year is lost from intellectual property theft. The German Interior Ministry estimates that Chinese economic espionage costs the German economy somewhere between EUR 20 billion and EUR 50 billion a year, so the Americans are not alone in their deep concern for IP theft.

But of course, it's not just the Chinese that are responsible for these outcomes. I think the European side, over the years, could have been much more forceful at pushing China to end this activity coming from within its borders. In that sense, we, in Europe and in the West, are also to blame for not having a stronger push back against this frequent IP theft that was coming out of China.

SP: So Luke, it's it strikes me from listening to what you're saying that we're sort of faced with a choice. Maybe there's a third way but it seems like either we cut China out of our economies, and we cease economic engagement with China to protect the models that we have and the values we have, or we have to push back by effectively becoming more like them, and accepting deeper state involvement in our economies, in order to protect our industries, and that the muddled middle way of turning a blind eye here and a blind eye there, but actually engaging in some sort of industrial policy occasionally when either the lobbyists are very good, or we deem it so strategically important that the state has to get involved, is kind of failing. Would you agree with that?

LP: I think there needs to be a deeper recognition that industrial policy can actually do good things for Europe. As you mentioned, we have done it before. Airbus is partially a consequence of focused industrial policy on the side of Europeans in the past, but at some point, we lost our sort of geopolitical and competitive muscle in Europe. The industries that have faced pressure – the solar industry has been undercut from subsidies going into Chinese solar power companies from IP theft, and the telecom industry, right, Huawei has been taking large market shares from Ericsson and Nokia around the globe – in Europe, these industries, when they were facing this pressure in the 2010s, they certainly raised this with Brussels, and were concerned about it. We saw even European Trade Commissioners in the past want to take on a trade dispute with Beijing over the solar industry or over telecom industry and push anti-dumping measures ahead.

But at each point, there wasn't European unity. There were typically different member states, particularly Germany, that were worried about sort of the broader trade relationship with China. They were worried about upsetting the positions of the automobile industry, in particular, in its grand designs for capturing market share in China. So we saw a weak response from the EU. So I think part of the battle is just defending the European market, which the EU in particular is still the largest common market in the world. And it's about ensuring that companies that operate here are doing so on a level playing field. But it's also I think about going beyond a defensive game in Europe, and playing offence as well.

That means considering how we might expand the reach of European lead firms, like in the telecoms and wind industries, and expand their reach in developing and emerging economies in particular. Because we're doing well, in the US, China is becoming a more difficult place to operate, at least for these two industries, and so the global south is really the key battlefield. And to exploit development finance and other means of support to help European firms expand abroad is, I think, something that needs to be pursued, moving ahead.

SO: It's funny that you talk about the global south because Stewart and I have long mentioned the fact that China is actively engaging with the global south in a mercantilist approach, because there is quite clearly a move to cut Western trade and Western influence off from parts of the global south by Beijing. The issue, though, that we face when it comes to technology is the fact that China uses its immense savings to undercut the competition and to give subsidies to his own firms. For example, Huawei is estimated to have a USD 100 billion credit line and routinely gives loans to countries such as Brazil, Nigeria – the countries that spring to mind – at a 1% interest rate for them to buy specifically Huawei goods. ZTE are doing the same thing, no doubt and other Chinese companies too.

How can Europe compete with economic muscle like that, but also the political elite capture programmes that happened behind the scenes from China? Because surely, this is verging on sort of more murky territory, and Europe and America can't really be seen to be getting into the weeds like that. Don't you think that China has got an inbuilt advantage by its unwillingness to not abide by international norms?

LP: I think there is a lot to unpack there. I think firstly, China has done an excellent job of selling the idea that it dominates in the global south in these two industries and across a lot of different important industries. So take telecommunications, I think the conventional thinking is that Huawei and its Chinese counterpart ZTE, really have large majority stakes across Africa, Latin America, developing Asia, and that Ericsson and Nokia and other Western firms have really been pushed to the periphery. However, if you sit down and look at the actual figures, the only region in the world where Huawei and ZTE have more market share than Ericsson and Nokia is in Asia – and that is particularly because China is a, you know, a massive telecom market, representing somewhere between 40 to 50% of the current 5G market. So even when it comes to developing an emerging economies, it's Nokia and Ericsson that have higher market shares in the global south than Huawei and ZTE. And this comes from Dell’Oro figures from recent years.

So there is a fierce competition in the global south. But even though as you mentioned, Huawei has been receiving tremendous support from Beijing, European counterparts have lost ground, but they have held on to large stakes, in countries like Brazil, as well as like India who is turning away from using Chinese technology. So, there are major emerging economies where European telecom companies, where European wind power companies are being welcomed, because China, although it has a broadly positive relationship with the global south has sort of stepped on a few toes there as well, particularly in India. So I think, some financial support from the EU that is geared towards helping these economies develop further in telecoms, or in wind power generation to address climate change, is warranted and can actually gain some traction.

And I think we've seen, to be frank, European companies engage in plenty of corrupt dealings in the past as well. So while these are not values that I think most European capitals would want to promote, even recently we’ve seen the Department of Justice in the US has fined Ericsson for corrupt practices, just to give one example. So I think European companies have also sort of displayed these types of tactics as well.

SP: Luke, in your fantastic analysis of the wind turbine market, you highlight perhaps a misstep by the EU in putting countervailing duties on steel plate imports from China, which actually ended up disadvantaging the Danes or the European producers, vis-à-vis third countries who could still import Chinese steel plate cheaply, and then export turbines into the EU potentially.

Perhaps you could just elaborate, if you were advising the UK government now or the European Union now on the best approach to pushing back against China's trade practices, what would you actually be recommending to them?

LP: I think in the last ten years, we have put too much emphasis on the marginal interests of the lead European firms, and what they hope to achieve in China, and therefore we've stepped away from any trade confrontation with the Chinese as a result. So I think the first piece of advice is to look at the wider supply chain, the wider industry in Europe. We have to remember that small and medium sized enterprises make up between 50% and 60% of the European economy. It's not the big firms, like Ericsson or Volkswagen or Vestas that are driving our economy forward. It's the small and medium sized enterprises. These are the enterprises that produce the jobs, that produce the income, that produce the taxes that underpin European welfare. So, we should focus not only on the lead firms, but also on this wider industry.

And secondly, we need to be aware that China and the United States, by the way, have a tendency to divide interests within our supply chains in Europe. So, selling cheaper steel allows Vestas and Siemens Gamesa to buy Chinese-built wind towers and other components at a cheaper price. They gain the advantages of Beijing’s subsidies and state support for its home wind industry. But European suppliers of those components lose out – they go bankrupt. Wind tower companies in Germany and Portugal go under, Danish firms are struggling as a result of the subsidies, undercutting their own prices. The European Union and countries in Europe, including the UK need to be more responsive to the needs and the interests of this wider supply chain. That's where I would put my focus because China understands this. China understands that you want to capture as much of the supply chain as you can. And don't think that Europe can't do scale. Europe is a huge economy. We can still do scale we can compete with the Chinese in this sort of industrial capacity, if we frame our perspective towards the wider industry, and not just the lead firms.

SO: Luke, we are out of time, sadly, but thank you so much for an amazing analysis. And I have certainly learnt a lot about this. Now, your book, How China Loses, obviously everyone needs to read if they haven't read it already. But you have been working on some new articles recently for The Wire and other publciations. Any more books we can look forward to you publishing soon?

LP: Nothing on the near horizon. But I think my work for the Wire China is starting to get more about at this idea of the European-China relationship in isolation of what is going on between the US and China. I think it's important that we keep a bigger focus on how Europe and China's relationship is changing over the years and our own experiences dealing with the Chinese.

SO: Great. Well, thanks very much, Luke. And we'll be back next week, Stewart and I, for more What China Wants, goodbye.

Episode 18: Is China Destroying Europe's Tech Companies?