Hello and welcome to Episode 9 of the What China Wants podcast.

With all that’s happening in No10 Downing Street and the efforts to remove Boris Johnson from power, it’s interesting timing that today’s episode is about what could be one of the British PM’s last contributions to Western diplomacy.

On 26 June he, President Biden, and the other leaders of the G7 announced a massive new fund called the Partnership for Global Infrastructure Investment, or PGII. Designed to provide a Western alternative to China’s Belt & Road Initiative, Sam and Stewart discuss what it is, how it is different to the BRI, and whether or not it has a cat-in-hell’s chance of succeeding.

Our main points from today’s episode:

The new Partnership for Global Infrastructure Investment (PGII) has just been launched by the G7 group of countries led by the US and UK. It is designed to compete against China’s well-established Belt & Road Initiative (BRI)

Its funding of $600 billion may not seem much compared to the trillions supposedly invested by the BRI, but there is some debate as to exactly how much the BRI has spent - and this opacity is in stark contrast to how the values-driven PGII is designed to perform

The proof in the pudding will be if developing world nations want more than just cheap credit to build roads and 5G, and are happy to be bound by the PGII’s values

As such, countries with the worst governance records are not likely to ditch the BRI for the PGII (or even sign up to both) - but those countries that want to progress up the values curve may well do

You can also listen to the podcast on Apple, Amazon, or Spotify.

Finally, if you enjoy reading about China, but want to look at it from the Chinese point of view, then I have a recommendation for you: the Pekingnology newsletter. (Yes, he knows he spelt that wrong.) The author, Zichen Wang, writes well and about a wide range of topics, so do check it out if you want to see things from “the other side”.

As always please do share, comment, and subscribe. We’ll be back next week.

Many thanks for listening.

***

Here is the transcript for those of you who prefer a more traditional media experience…

Sam Olsen: "The Belt and Road Initiative may be China's idea, but its opportunities and outcomes are going to benefit the world. China has no geopolitical motives, seeks new exclusionary blocks, and imposes no business deals and others."

Can you guess who that was, Stewart?

Stewart Paterson: I'm guessing it's the President of China and the Secretary General of the Communist Party Xi Jinping, is it?

SO: It was, speaking in 2017. For some reason, we've got into the habit of every episode of What China Wants starting with a quote from Xi Jinping. I suppose it's just the gift that keeps on giving, but in this case, it is very pertinent because we're talking about the Partnership for Global Infrastructure Investment [PGII] which is the recently announced equivalent of the Belt and Road Initiative, or BRI, that the West and mainly America and Britain have now agreed to set up.

We thought that it would be very good to go through this and have a look and see what this means - what this means for the West, what this means to the rest of the world, and how it compares to the BRI. But I suppose that the first question is, Stewart, what is the PGII?

SP: So I think this is Build Back Better World Mark Two, isn't it, Sam?

SO: It is, yes.

SP: It’s just a rebranding of what had come out before. The headline numbers look big in the sense that the sort of title number that is thrown around is $600 billion. But my understanding of that is that 200 billion of it is US taxpayers money, and the rest of it has to come from other G7 countries and the private sector. And so, $600 billion does sound like an awful lot. The target I think is distributed over five years, which again, might be ambitious, in fact, because it just takes a long time to find the right projects and finance them.

So I wouldn't hold my breath in terms of the timeline. But what's your understanding of it? Does that gel with what you've seen, Sam, and what's the political background to that?

SO: Well, the Partnership for Global Infrastructure and Investment is designed to do exactly that, which is to build a partnership between the western countries and between those western countries and the developing world to invest in infrastructure. And you're right, a $600 billion is the headline figure over five years, $200 billion from America and $400 billion from the rest. I don't think there has been an announcement on exactly how that other $400 billion has been broken down, but it is going to compete against a BRI which is significantly more funded, as we'll get on to in a moment.

The four main priority areas for the PGI are climate and energy security, digital connectivity, health systems and health security, and gender equality and equity. And the plan is for America leading the way and the rest of us following, to get out there and to say to the developing world, "hey, listen, we've got money, we can invest in your projects in these four areas. What have you got for us? And how can we help?"

SP: Given your expertise, it's the digital side that has caught your attention is it? Why might that be important?

SO: Well, it is. Actually, that makes a very good question in terms of where the West is, with regard to its competition with China, because something that hasn't really been focused on too much by people is the fight over standards, especially technological standards. And we should make no bones about it. The PGI and the BRI will be competing on technological standards. But before we get onto that, I think maybe it's of interest to look at why that's important from a political background.

Well, last year, the Build Back Better programme, which Biden wanted to launch internally, which is a kind of $2 trillion reinvestment in America, after years of neglecting their infrastructure programme. That was Biden's showpiece and the aim of Build Back Better Worldwide, which was launched at the G7 summit, was to capitalise on the initiative and the emphasis there and to create something globally that could compete against BRI. The problem with that was that it didn't work. And the reason didn't work is partly because the Build Back Better programme in America was killed by one of Biden's own senators. So therefore, that knocked the stuffing out of the international equivalent.

So this is a re-launch with significantly less money put into it than the Build Back Better Worldwide. But then things are very different. You have the war in Ukraine, the cost of living crisis which have all happened in the last year. So there is less money to go around, and I think people will feel less comfortable about telling their electorates that they're going to invest more in the developing world considering the tightening’s that's happening at home. But I think that there is a realisation, a political realisation, that something has to be done in order to compete against China.

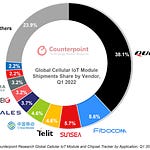

And then that brings us back to your earlier question about the digital side, in particular in the digital front, because we need to make no bones about it. The digital side is where China is winning against the West, is setting standards and setting its stall out in terms of its influence in those countries for years and years to come, because digital infrastructure now dictates so much whether it's defence and security, whether it's the direction of travel for the economy, whether it's the education and transport mechanisms within the country, so much of it depends increasingly so on digital infrastructure.

So for the West to really stand a chance competing against China in the developing world, in its long term influence has to look at the digital infrastructure side, and I was very glad to see it do it. The question is, Stewart for you is that from an economic point of view, is any of this going to work? Politically we can see the rationale, but from an economic point of view, is there any rationale behind us delving into such a big programme?

SP: I think to answer that, you have to start off by looking at what the economic rationale behind the Belt and Road Initiative is, and there's a very strong economic rationale behind it. China, as most of our listeners will be aware, saves a huge amount of money. So China has a savings rate that is not far off 50% of GDP. And despite the fact that they have some of the highest levels of domestic investment in the world - that the world's ever seen in fact - over a very sustained period, investment to GDP is about 45% of GDP in China, they have a savings surplus. And if you have a savings surplus, you have to export those savings, so that's reflected in the current account surplus that China runs.

In the last five years, for example, China's cumulative current account surplus has been about $900 billion. That means that China has, on a net basis, exported $900 billion of capital. But those net exports of capital are augmented to the degree to which foreigners invest in China. And in the last five years, foreigners have bought about $2.5 trillion of investments in China. So taking the $900 billion of current account surplus, plus foreigners' gross investment in China of $2.5 trillion or so, that means that there's been about $3.3 trillion of capital exports from China over the last five years.

Now, historically, what China did before 2013 was that most of the capital exports from China simply went into foreign exchange reserves. China was buying US Treasuries primarily, but also other central bank assets, rather the liabilities of those central banks or governments, which were China's overseas assets. But since the sort of going out programme and the diversification of China's capital outflows, they've largely stopped buying foreign exchange reserves or acquiring foreign exchange reserves. And the state-owned enterprises have taken the lead in investing overseas. Now, there's an obvious problem with the G7 pushback to this, and that is that the United States is a net capital importer, not a net capital exporter like China, and therefore, its firepower is constrained by the willingness of countries that are capital exporters to buy US assets, because that really is the determinant of how much the US can put overseas.

SO: Can I just be clear of something Stewart, just for the sake of those listeners who are more on my side than on your side in terms of expertise, is what you're saying is that America is going to have to borrow money in order to re-export that money through the PGII?

SP: Borrowing is the wrong word because borrowing implies debt and capital outflows can take any form, they could be equity or debt. Obviously, the government element will have to be borrowed because the government is running a deficit in the United States. In the private sector, capital exports could come in any shape that it is contingent on someone buying the dollar. A currency is a closed loop system; when someone sells a US dollar, someone on the other side has to buy it. Now, of course, some of this investment might be denominated in dollars, but ultimately, those dollars will have to be sold by the cement the steel or whatever it is, unless that is coming from the United States, or denominated in dollars. So America's ability to invest overseas is constrained by the fact that it doesn't save enough domestically to actually cover its domestic investment requirements, whereas China produces this domestic savings surplus.

Obviously, China's capital exports have been largely state-driven. There's an organisation called the State Administration for Foreign Exchange, 'SAFE' as they're called, who oversee China's capital account. What's interesting is that even their own statistics do not account satisfactorily for the capital outflows. So the errors and omissions number over the last five years has actually been just shy of $1 trillion. So there have been $1 trillion of capital exports from China over the last five years, that the state authorities don't know where it's gone, which is surprising given the tightness of their capital controls.

So really, China's capital exports fall into two categories, I would argue. One is tightly state controlled and directed investments overseas, and the other is illicit or semi-illicit capital flight from China, which arguably has nothing to do with the regime. In fact, it's potentially savings trying to escape the grasp of the regime. But those numbers give you an idea of the quantum of investment that is and has been going overseas from China. So officially China has about $6.6 trillion of overseas assets that the government know about, there might be closer to $8 trillion when you include that that they don't know about. Now looked at from that perspective, $600 billion does not seem very much.

SO: What percentage of that has gone through the Belt and Road? I look at figures, sometimes people say $1 trillion, sometimes people say $4 trillion over the last 10 years. Do we know?

SP: Well, there's a massive difference between the headline numbers that you see talked about, and what can actually be accounted for when you drill down on a project-by-project basis. So for example, if you look at the American Enterprise Institute's China Global Investment Tracker, which is a fantastic resource that I'd encourage our listeners to utilise, they would argue that total investment and construction activity, going back to 2005, and obviously, most of its happened since 2013 - in fact, all of its happened since 2013 - that is associated with Belt and Road is only about $800 billion. Now, that would contrast very sharply with the propaganda and headline hyperbole that might put Belt and Road's value in the trillions of dollars.

Clearly, this is a reflection of several things - the overstatement of the value of headline projects, the problems that some of the projects have run into, in terms of they just simply haven't come to fruition, and of course, many of them get scaled back when the true economic costs of the host country that comes apparent. So again, looked at from that prism, the $800 billion of BRI money since 2013, then the $600 billion is comparable.

I suppose the question I'd ask you, Sam, here is, is this even the right approach? We know that China uses its BRI projects to promote its state-owned enterprises, to in some ways dump surplus cement and steel capacity from China overseas. It also creates employment for Chinese workers who then move overseas. These are not traits that would be associated, I think, with the G7 equivalent. But we also know that China cultivates structural influence in countries through the ownership of infrastructure. Is that a route that we should be trying to follow? Or should we actually not be trying to compete on the infrastructure side so much as on the soft infrastructure, the digital side, the software, the engineering?

SO: So first of all, I hadn't actually thought about it, but you're right, that China does use the BRI to export an awful lot of manpower. I use that word advisedly, because it's almost entirely men being sent abroad, partly to compensate for the fact that China's got between 20 and 40 million extra men, thanks to female infanticide over the last 30, 40 years, as a result of the one child per family regime. So that's a lot of extra men that they need to get rid of, and the BRI provides a great mechanism to do so by saying "we'll build your bridge in Nigeria, or Laos, but you have to take 22,000 men in exchange." I don't think the UK or America is going to start exporting their manpower like that.

In terms of the main crux of your question, is it actually worthwhile us doing it? Well, I'd take a leaf out of your book and say, "well, let's have a look at the BRI". There are many reasons for BRI in fact. It is not just about the economics; from the politics side, they get an awful lot of influence in these countries because 138 nations have now signed up to the BRI, including 38 in Sub Saharan Africa, to a greater or lesser extent, of course, not every country signs up to every single part of it. But what is interesting is that it is the countries where China has the greatest influence as you and I have measured using our influence models. It's no coincidence that the countries which feel the greatest influence from China are those perhaps most indebted China through the BRI.

But it's not just about the here and now and about creating debt diplomacy, we know that that's overstated. Lots of countries have far greater debt to the West than they do to China in pure monetary value. But what is important is the political and economic debt that the BRI can foster in these countries. A good example for that is where the BRI, for example, leads to the construction of military infrastructure, or health infrastructure. This gives China an awful lot of influence, not just about the now but the future.

And I mentioned that with regard to digital infrastructure. China, in exporting digital infrastructure puts its hands on the levers of development for many countries, and that is really important for the long-term decision making of that country. I think the West has to go toe to toe with China, if it wants to actually have a say in that. There are many examples that you and I spoke about I mean, do you remember speaking about the Pacific last week? It's quite clear that the Pacific has been targeted through the BRI and other similar initiatives in order to capture parts of those countries which would be best suited for providing long term influence for China, whether it's building out the fisheries, or whether it's building more of the additional infrastructure. It is not about the here and now, necessarily, it is majority looking at the future. And economically, I suppose that makes sense.

SP: One of the key issues with BRI has been the potential for corruption, and elite capture through BRI projects lining the pockets, effectively, of local politicians and local business elites, which then of course, compromises them. Now, presumably, the G7 alternative is not going to be aimed at elite capture. Therefore, will we actually find fertile ground because presumably, those decision makers who are trying to do the right thing by their country and get value for money, do need an alternative source of funding to China but that has been available through the multinational development, banks, etc. Those that have chosen to go down the BRI road, have either done so because of a genuine cost-benefit analysis, that means that China is the cheaper alternative, or because there has been a kickback for them as a result of doing so. If China is the cheapest alternative, it will probably remain so, and if people are after a kickback well, they won't be getting that from G7. So I'm just wondering whether we will be able to disperse the money?

SO: Well, good question, Stewart. For me, the greatest strength of the PGII is actually also its greatest weakness. Now in a quite stark contrast, the PGII has made a great deal about it being a values-driven programme with high standards, transparency, and so on. That is not the same as the BRI, and we don't even know how much that the BRI has spent for starters. But I think that if you are looking to compete against the BRI, with countries with less than perfect value systems, where the elites basically can do what they want, then yes, there will be difficulties there competing, especially considering the beneficial economic terms that the BRI often comes up with.

But I think what we must realise is that there are an awful lot of countries around the world, the majority, I would say, who actively do want to progress along the values curve. And there are people within those countries who are trying to make the case for that almost without exception. So what the PGII does is it gives the people within the countries who do want to progress in that way, an alternative to the BRI, and it strengthens their hand. So, not every battle against the BRI will be won, and not every single piece of infrastructure development will be lilywhite perfect. But there will be the potential for those people that do want to move towards the values-driven investment side to have an alternative that they can get their hands on.

SP: So Sam, in your view, which countries or which regions would G7 get the most bang for its buck from competing head on with the Chinese infrastructure development?

SO: Well, that's a good question. And I can only really talk from a political point of view. I'd like to know your answers on the economic side. But I would love to be able to see some of the sort of the documentation behind this. My gut feeling is that this is primarily aimed at those countries on the periphery between developed and developing, for example, Eastern Europe, some of the more advanced countries in Africa and in Asia, where there is more of a rule of law, where there is more of a debate internally about 'doing the right thing'.

Countries which are much more beholden on China because of the corruption at the elite level - Zimbabwe, for example - I don't think that PGII is going to have much luck there. But if you just look at some of the countries which have been announced as being primary recipients of the PGII money, it's Angola, well, that's a bit of a surprise, but Senegal, yes, they are doing alright, a modular nuclear reactor in Romania, exactly the kind of country that I'd expect would be politically able to take advantage of this. But from an economic point of view, I mean, just think there will be a split in those countries that find it beneficial, and those that prefer the BRI? Is it just about cheapest at the end of the day, if you take the political side out?

SP: I think the value for money proposition is important. But equally, I think one has to be aware that there are countries where there simply don't exist, the domestic expertise and capabilities to build the kind of hard infrastructure that a modern economy requires. And China, because of its large domestic investment programme, has developed large scale construction and engineering companies that are capable of executing projects cheaply, on time, fast, and that has had considerable appeal. So if you look at the success of the economic corridors through Pakistan, for example, and into Southeast Asia, Chinese SOE construction companies have been incredibly heavily involved in that.

And I guess what the West should be offering by way of competition is more skills transfer and technological transfer. Because the impression I have is that that has not been a factor in BRI. It's very much been that the Chinese companies move in, the Chinese workers move in, Chinese materials are used, the projects completed, and well, many of the Chinese workers then stay, but there isn't the skills transfer. And so to my mind, maybe more of a facilitation approach and a greater degree of local participation, local content, and establishing local companies who can then take the infrastructure development forward, is perhaps the way to win hearts and minds, as well as offering a sort of value proposition.

SO: I think you've really hit the nail on the head there. If this PGII becomes just a vehicle for getting the most value for money, then I think we will lose as the West time and time again against the Chinese - it has to be much more than that. And the skills transfer, making sure that we tell the world that this is about values and about helping countries to develop for the longer term, rather than just for the short term 'build a dam and see what happens'. I think all of those things need to be in the messaging. But at the end of the day, if there is no money to invest, then obviously that won't get very far in their hearts or the minds of the target countries. So it is a combination between economic push, and political messaging. And so Stewart, just for a final thought, what's your gut feeling? Is this going to work? Or is this going to be killed by the BRI?

SP: I don't think either extreme is necessarily what's going to happen. I think that when you define, what would you define as working, I think that this project will have worked if policymakers in the global south are given a genuine alternative to accepting Chinese capital. And if our value system and transparency are increased as a result of offering that. It will also worked, I suppose, if we can help curb the spread of sort of China's information technology infrastructure around the world, because I think that poses a significant threat to the sovereignty of many countries in the Global South.

But to do that, we need to have a good product offering of our own. And in the area of 5G, we've been found wanting, or at least that is the common perception. 5G has gained acceptance in much of the world, because it's perceived as being the only option. And for me, my question really, is this, would this money have been better spent making sure that we do have the product offerings available to give people a genuine choice?

SO: Very good question. And I think what we need to do is come back for another podcast and talk about the West's technological options when it comes to competing against China - and we actually have a guest lined up for that, but more on that later. Right, we'd better call it time there, Stewart. Thanks very much to everyone, for listening. We'll be back with a new episode of What China Wants next week. Goodbye.

Share this post