What the UK's Integrated Review Refresh means for China, and Beijing's Economic Preparations for Conflict

A few thoughts on China in the news

Welcome back to our fortnightly column on China in the news. The What China Wants podcast will return next week.

Please do give us some feedback, including on any news stories you want us to write about. Many thanks for reading.

A Refreshed Look at China

This week the UK published its Integrated Review Refresh. For those of you not familiar with the original Integrated Review (published in 2021), this was a once-in-a-generation report designed to bring together British foreign, defence, and international development policies. Partly it was meant to deal with the changing geopolitical situation, partly it was aimed at putting Britain on a new course post-Brexit. Overall it was pretty well received.

A major decision in the original IR was the tilt to the Indo-Pacific, which continues apace with news that the UK is likely to soon join the CPTPP, the Pacific’s huge trade bloc.

Given the Tilt, and the recent AUKUS announcement, it is no surprise that there was plenty of mention on China in the Refresh.

A major success for the China watching community was that the report called for a doubling of Whitehall experience on the PRC (even if this is from a very low base), although how this is implemented remains to be seen.

On the downside, what was slightly concerning to some is that it is clear that the UK still doesn’t know how to position China in its own mind. The People’s Republic is labelled “an epoch-defining challenge to the type of international order we want to see”, but at the same time there are calls for the UK to “engage directly with China bilaterally and in international fora so that we leave room for open, constructive and predictable relations”.

To some, this will beg the question of whether Beijing is a threat or a partner. To me, the refusal to put Beijing into a corner labelled “enemy” is a responsible position to take. The UK is heavily exposed to China in many areas, from rare earths to education to the overall logistics chain, as our paper in December showed. If the IRR had suggested taking a blunt, rather than a nuanced approach to China then this would have left us mightily exposed to potential punitive actions by Beijing.

To put it simply, the UK and its allies are not yet in a strong enough position to fully push back on China. To do so at this stage would be to summon economic and political turmoil far in excess of what has happened since Russia invaded Ukraine. To that end, the IRR must be applauded for its balance in raising the challenge of China and for announcing that more study is needed, without raising the stakes too high.

I have a newspaper article about it coming out soon (once reporting on the Budget is done and dusted), which will contain my expanded thoughts on this.

Russia and China’s Economic Preparations for Conflict

Never mind the UK’s attempts to reduce its dependency on China. In What China Wants we have spoken many times before about how Beijing seems to be preparing itself economically for some kind of escalation with America and its allies.

The reason China needs to take these steps is that it currently needs dollars – hundreds of billions of them each year – to pay for fuel, food, and critical technologies. If the US cut them out of the dollar system now then this would be problematic for Beijing, to say the least.

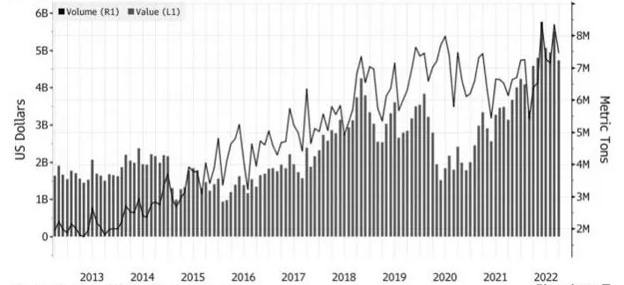

To that end, Russia’s new status as pariah of the West is economically very helpful to China. Figures just published show that 2022 saw a new peak in trade between Moscow and Beijing, at USD 185 billion, and the first few months of 2023 have seen even more rises.

By taking more oil and food from Russia, China is insulating itself from action by more Western-friendly nations in case of conflict with the US, although it probably isn’t possible for Russia to provide it with all the country’s needs.

What is also important to note is that much of Russia-China trade these days is not in dollars, the result of an active decision for both countries to de-dollarise. Giving up the greenback for now is not possible without economic chaos ensuing, as Putin himself recognised last year. But Russia buying more and more RMB supports Beijing’s efforts to internationalise its currency, something that hasn’t so far really taken off.

China’s development of economic defences continue in myriad ways, from Dual Circulation strategy, to the buying of more gold, to attempts to get Saudi Arabia to price some of its oil in RMB. So far, so normal for a country that increasingly thinks America is out to get it. What will be of concern is when China’s efforts here start to slacken, because at that point they will probably have concluded that they are strong enough to withstand whatever the West can throw at them.

Should this happen, then we can expect to see the pressure on Taiwan properly intensify.