We need to prepare for the Great Split between China and the West

There is a terrible risk of a grand decoupling

Hello and welcome to What China Wants.

Following on from last week’s discussion about how China is potentially looking to use Russia as a strategic reserve for resources like oil, gas, and wheat in the event of a sudden downturn in relations with the West, today I’m discussing what that downturn could look like.

It is a longer than normal newsletter today, but an important one as I discuss the potential for the Great Split between China and the West. I don’t have a crystal ball and so what I describe is only a scenario, but it is a scenario that seems to be getting closer to happening with each month that passes.

Indeed, it is real enough that governments and companies should probably start contingency planning for it now. The economic pain caused by the decoupling of Russia from the global system is hard, but splitting China and the West would be a whole new ball game.

As always, many thanks for reading and please do like, share, and comment.

***

Russia’s invasion of Ukraine has caused worldwide economic and political changes at a speed unprecedented since perhaps the end of the Cold War. The sanctions placed on Moscow by the West and its allies have taken a heavy toll on the country, with the rouble collapsing and inflation rocketing. Hundreds of international companies have withdrawn from Russia and there are shortages in shops across the country.

It is not just Russia that has been affected, however. The price of oil, wheat, fertiliser, and other commodities has jumped enormously in the last month, raising fears of food and energy shortages across the world. Combined with the impact of the measures taken in reaction to Covid, reports indicate that Britain is likely to suffer its biggest fall in living standards since the 1950s as inflation and the general cost of living balloon.

For all the damage caused by this economic turmoil, the impact might not be that big in the end, perhaps equating to a 1-2% decline in world GDP (which sounds a lot, but is manageable). What would have been far worse is if it had been China, not Russia on the other side of the sanctions.

Russia’s economy is relatively small – a little larger than Spain’s – and it has a significant position in only a small number of commodities, albeit important ones. China, on the other hand, is central to the global supply chain. It accounts for about 28% of global manufacturing and 18% of the world trade in goods, and so any action that cuts China off from worldwide supply chains would cause mutual economic damage on a much larger scale.

The Great Split

The bad news is that there is a high possibility that China and the West will be cut off from each other in what we are terming The Great Split. The logic is straight forward. America, Britain, Europe and their allies have set a precedent for themselves by sanctioning Russia for trying to upend the status quo. If China was to do the same – either by helping Russia, or by trying to invade Taiwan - then Washington and its supporters would in all probability place similar sanctions on Beijing, not least because it is America’s strategic benefit to do so.

China could of course accept these sanctions without much pushback, and so minimise the fallout. The problem is that Beijing has recently passed laws that allow for, and actually demand, a counter-sanction list to be created for any company complying with Western sanctions, with punishments including visa revocation and the freezing of assets. Although Beijing has kept its guidance on exactly how this would pan out (in a typical move by the CCP, which likes to keep a grey interpretation of laws for as long as possible), we can assess in all probability what would happen should sanctions be initiated. Multinational companies operating in China (and probably Hong Kong too, although this is also unclear) would face the prospect of having to pull out of either the West or China, assuming that Boards would be intent on keeping their companies functioning and their in-country managers out of trouble. It is not hard to predict that with Western economies representing the lion’s share of world GDP that many, if not most would immediately pull out of China at the onset of sanctions.

This would be the Great Split: the quick, deep, and politically-pushed decoupling of the economies of China and the West.

The Sparks That Could Lead to Economic War

The Great Split would be a significant economic shock that most would want to avoid. Unfortunately, there are two potential sparks that could ignite it.

The first is the Russian invasion of Ukraine. If Beijing helps Moscow avoid sanctions, and Washington chooses to do something about it, then secondary sanctions could be placed on China. However, China’s economic defences are not quite ready yet. The country still relies enormously on imports of foreign technology from the West and its allies like Japan and South Korea; in addition it spends hundreds of billions of dollars a year on food and fuel. Being cut off from all this anytime soon would be catastrophic for the Chinese economy, and so it is unlikely that Beijing would risk initiating the Great Split this way – at least not yet.

A more likely spark is Taiwan. President Xi has repeatedly pronounced that his government intends to bring what it considers a renegade province back under control. “The historical task of the complete reunification of the motherland must be fulfilled and will certainly be fulfilled,” said Xi in October 2021. Anyone standing in the way of Beijing’s ambitions would be “crushed”, he said in another speech a few months before, commemorating the centenary of the founding of the Chinese Communist Party (CCP). “No one should underestimate the Chinese people’s staunch determination, firm will, and strong ability to defend national sovereignty and territorial integrity”.

There are of course those in the West who think that the bloody nose suffered by Russian forces makes it less likely that China will think of invading Taiwan. The retort to this is that the People’s Liberation Army is the armed wing of the Chinese Communist Party and puts its loyalty to the Party above anything else. Bringing Taiwan to heel is now so entwined with the aims of the country’s leadership that to abandon reunification as a policy would be seen as undermining the very legitimacy of both Xi and the CCP, something that is too close to losing the “mandate of heaven” to be allowed to happen.

Indeed, there has been no mention of any change of policy about Taiwan since the start of the Ukrainian war. Rather, the policy of reunification has continued to be repeated. Just as Putin repeatedly warned that he would do something about the problem of Ukraine, CCP officials, including the President himself, are hiding their intentions in plain sight.

America Defending its Position

But it takes two to tango. Just because China takes (or tries to take) Taiwan, it doesn’t mean that the US will do anything about it. After all, Washington has repeatedly failed to confirm that it would fight on Taiwan’s behalf, even if President Biden has gone off script a couple of times. Some also claim that the economic chaos that Western sanctions would cause is too much for the US to seriously consider punishing China for anything they do regarding Taiwan.

This is false logic, for several reasons.

First, Washington lawmakers have repeatedly threatened sanctions against China if it either helps Russia, or invade Taiwan. This does not mean that these sanctions would materialise – Obama’s threats about “crossing red lines” generally didn’t – but there is another factor at play that makes some kind of hardball response very likely. American policy makers understand the criticality of standing up for Taiwan in the event of Chinese action, because they know if they don’t, then their country’s primacy in Asia would be over. President Biden’s ill-managed decision to pull out of Kabul sowed significant doubts in friendly capitals about Washington’s commitment to the region, doubts that were fanned by Beijing’s proclamation that “the US is in Asia by choice, but China by geography”. Given how much noise American politicians have made about defending Taiwan, if China was to take the island then belief in America’s security guarantees across its regional allies would disappear overnight.

Thus, China’s Taiwan ambitions, together with America’s determination to remain top dog, mean that any move on forceful reunification is likely to trigger the Great Split.

The Pain That Will Come

Given the ties between China and the West, the Great Split will be enormously painful for both sides. The difference is that China is preparing for it; the West, less so.

In recent years Beijing has put in place a number of measures aimed at lowering the cost of Western sanctions, planning that was invigorated by the actions of President Trump following the launch of his trade war and the investment blacklist against the People’s Republic.

There are a number of layers of defence. One is the “Dual Circulation” strategy, which seeks to make the country more self-reliant, including in technology. Another is the move to create a RMB bloc which would allow Beijing to use its own currency to buy critical products (like food and fuel) using its own currency rather than relying on dollars. This “de-dollarisation” has been a feature of trade with Russia for several years now, and is being accelerated by the adoption of the digital Yuan. A third form of defence is the opening up of China to Wall Street investment. As of the end of 2020 American investors owned $1.2 trillion of Chinese securities ($1.1 trillion of equities, and $100 billion of debt), and would likely lose much or all this in the event of a Great Split. This makes the American investor community a useful ally in trying to dissuade the US Administration from launching sanctions against China.

Western plans, by contrast, are either nascent or non-existent. This may be because there remains a sense of optimism that economics will trump politics, despite history repeatedly proving the opposite: Britain and Germany in 1914, and the US and Japan in 1941 were both examples of highly integrated economic relationships that failed to stop war. Although there are signs that Western governments are starting to prepare for the worst, there does not yet appear to be the understanding of the breadth and depth of influence that China has over countries in the West, in everything from raw materials to investment in education.

Take rare earths, a group of 17 elements that are vital for the modern economy, including for the clean energy transition. American officials made a great effort to reopen the Mountain Pass rare earths mine in California so that they could say they were no longer dependent on Chinese minerals. However, the ores mined in Mountain Pass are sent to China for processing because the US has effectively no domestic processing capacity . This is of major strategic concern given that Western manufacturing and defence is dependent on rare earths – each F35 fighter jet, for example, contains 416 kg of these metals. America and Australia in particular are looking to open some processing facilities to become more self-sufficient, but this will take time to implement.

Looking at the UK specifically, it is clear that China has built up considerable influence in the country across myriad sectors. In education, the UK hosts more students from China than there are undergraduates from Wales, and without them many universities would be financially devastated. The banking industry is also particularly exposed, as HSBC, Standard Chartered, and other British institutions have $600 billion in loans to China and Hong Kong, and rely on the former British Colony in particular for much of their profits. In the event of the Great Split it is likely that British banks and other firms with significant China exposure would see their Chinese assets taken away, in effect splitting these companies in two.

Desperate as these consequences of the Great Split sound, they are overshadowed by what could be the biggest shock of all: the disruption of the global supply chain in microchips.

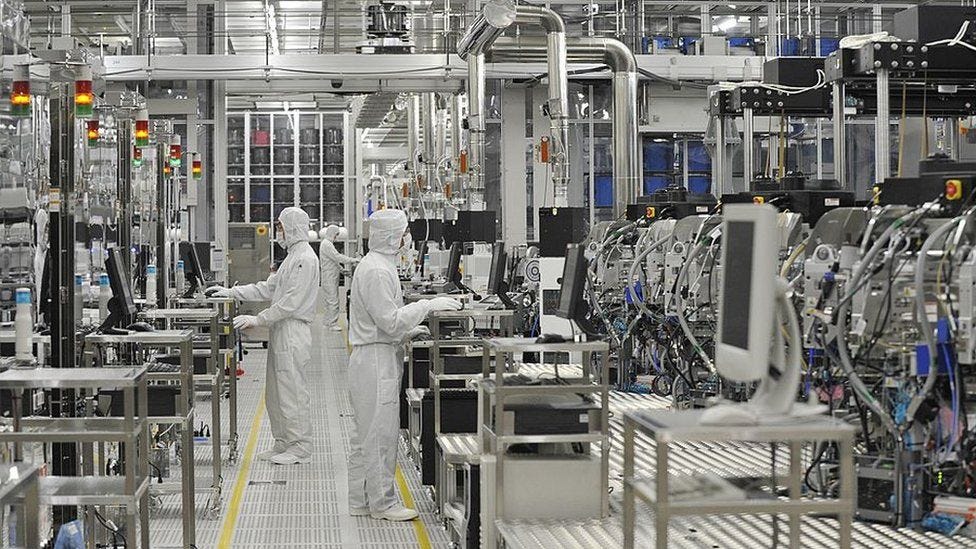

At the heart of the worldwide economy lies the computer chip, powering everything from your mobile to your car to your office. At the heart of the computer chip industry lies Taiwan. Just one of the island’s companies – TSMC – has more than a 50% global market share of semiconductor manufacturing, and four of the top ten companies are based there. 92% of the world’s most advanced microchips are produced in Taiwan.

The world has already had a taste of a microchip shortage thanks to Covid. The lack of supply over the last year and a half caused by interruptions to the semiconductor supply chain have had a dramatic effect, costing the auto industry alone an estimated $210 billion just in 2021; car production in the UK fell to its lowest level in 65 years thanks to the shortages.

A forced attempt at reunification will undoubtedly interrupt the supply of these chips at a scale considerably in excess of anything caused by Covid. This could be because of a Chinese blockade of the island, or the banning of the export of chips to Western nations by a CCP-compliant Taiwanese government, or because of collateral damage from any fighting. Whatever the reason, the West’s industrial and consumer economies will suffer heavily as a result.

Western Governments and Companies Need to Prepare for the Great Split

The future is never written in stone, but the prospects of the Great Split happening are real enough that governments and companies should at least prepare contingencies for it.

Many of the required trends, such as the onshoring of supply chains and the establishment of strategic reserves of goods, have already been encouraged thanks to Covid. But much more needs to be done, including the full mapping of country and company direct and indirect exposure to China and Taiwan.

We don’t know exactly when any push to reunification will happen, although before 2027 seems to be the date that some in Beijing are talking about. This gives the West time to get its act together, but only if contingencies are started soon.

This will be a substantial undertaking. But if the pandemic taught planners anything, it is that not being prepared is a lot more expensive in the long run.

The most alarming area is the Wests dependence on rare earth metals. The other areas such as microchips can be feasibly diversified across a multitude of countries without any major domestic pushback in those countries - it's a relatively clean process that is a good wealth generator - and that Taiwan being the epicentre of the industry, albeit they wont be happy, they're still an ally of the West. The same cannot be said of the rare earth metal processing plants which in comparison are far more polluting, especially when it comes to heavy metals. The Chinese state has fewer scruples about environmental damage as we in the west do, despite it being a growing area of concern for the Chinese population. Additionally, when it comes to technology transfer, we will not be able to so easily export expertise out of China due to hostilities, and so upskilling our own workforces on the necessary processes will take time.

Seems to me that the US is the one becoming ever more isolated, that as it pushes for a conflict with China and ever greater control of her (the US) vassals especially in Europe, Asia & America that she is growing more and more over-extended.

China meanwhile is outfoxing her with deal such as the French entertainment investments she's made, the Canadian pipeline to BC which will sell gas and oil to China, China's investment in the North-West Arctic straits that Canada owns (by right) (and that China supports), growing Chinese influence in Asian countries such as Japan, Philippines, Vietnam and others, and of course her influence over Germany, Italy and France, along with Africa. This along with the US Dollars' problems (that you mentioned good sir), seems to me like the US is facing tough times.

Don't have a dog in this fight, but it'd be nice if it was to utterly disappear. China wants influence or money sure whatever who cares? China will help China, if they want to invest in Quebec, Canada, France I'm glad, if the US wants to sure but the trouble is that the latter's investments keep coming with strings and tend to harm their vassals.