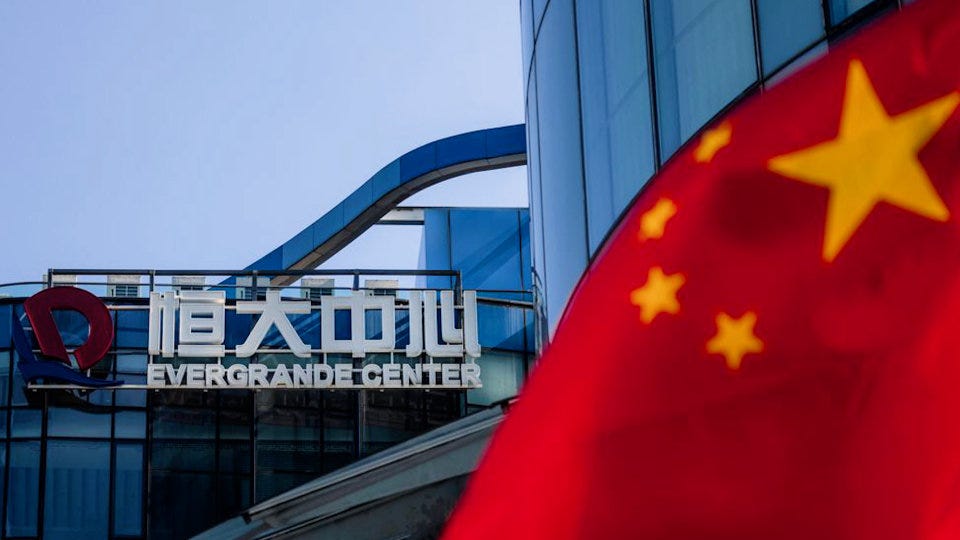

Understanding the Evergrande crisis

How the property developer's travails will impact China and the world

Dear fellow China watchers

As I’ve mentioned before, Series 2 of What China Wants is focused on the pushback on China’s global ambitions. But not all of this pushback comes from abroad: some, if not most of the issues that China will face as it tries to cement its global agenda will be home-grown.

Nowhere is this more vividly seen than what is happening with Chinese property developer giant Evergrande.

In case you missed it, the corporate giant has been struggling to pay the interest on its hyper-inflated debt-pile, which puts the company at dire risk of failure. The company has been widely cited in the press in recent weeks, and for good reason, because at the human end of things there are more than a million families that have bought flats that they might never see - not to mention all the tradesmen and suppliers who run the risk of not being paid. Corporate failures at this scale are rare, but when they happen, they tend to take down other chunks of the economy too.

Today we’re exploring what is actually happening to the developer, and what it means for China and the rest of the world. To do so I’m joined by our regular contributor Stewart Paterson. Stewart worked as a hedge fund manager in Asia for several decades, and since his return to the UK has written widely on China’s economy, not least in his book China, Trade and Power. He runs a consultancy, Capital Dialectics.

Many thanks for reading. As usual, if you have any comments to make then please do so, and do consider sharing and subscribing.

***

Sam Olsen: Can you describe what has happened to Evergrande?

Stewart Paterson: Evergrande is one of the largest property developers in China. It builds apartments across China, but also has sidelines in countless sectors, from theme parks to football clubs.

The problem for Evergrande is that it has massively overstretched itself. By doing so, it has put the wider Chinese, and wider global economy at risk.

For the last twenty years, residential property investment has become an increasingly important driver of China’s economy. Developers buy land use rights from the state, build flats, and make a margin.

Developers as a whole have run a highly leveraged business model to make a small amount of equity go a long way; total assets of the sector are funded by 20% equity and 80% liabilities. Evergrande has been particularly aggressive, thanks in part to the political protection it has enjoyed in the past. It has grown to an extraordinary size, with assets of $350 billion – of which only $50 billion is equity. To put this in context, this is the equivalent of 2% of China’s GDP.

Evergrande’s problem is that its business model has come up against government policy, in the form of the Three Red Lines policy that Xi Jinping introduced last year to force developers to de-leveage. This strategy is aimed at protecting the financial system of systemic risk from the property developers, and so it downplays the importance of the level of growth, and increases the importance of the resilience and quality of growth in keeping with the goals of Dual Circulation Strategy.

Specific to the real estate sector, the Governemnt has brought in three red policy lines to make the property developers deleverage:

1. They must have enough cash to cover short-term liabilities,

2. They must restructure their balance sheets to have at least 30% equity and only 70% liabilities,

3. They must have a net debt to equity ratio of less than 100%.

In short, these three Dual-Circulation inspired red lines have made Evergrande’s business model unsustainable. Indeed, the company’s difficulties are a victory for the Government’s policy as it’s making an example of them so other developers deleverage.

One thing to remember is that the property developers aren’t as crucial as they once were, because in many ways it’s job done when it comes to real estate: China has had decades of successful urbanization, and its living space is on a par with the developed world. Another reason that Xi feels that he can target the developers is that they have created a staggering amount of concentrated wealth – there are 215 Chinese real estate billionaires, with a total worth of $800 billion – whilst property prices in general are verging on the unaffordable. This has created an urban divide which the Government want to reduce.

SO: What does it mean for China?

SP: The main worry is that real estate has been such a driver for growth over the last four or so decades but particularly since the Great Financial Crisis, but now this is being curtailed, what will replace it?

China is lacking a new growth driver; first it was exports, but net exports have contracted to 2% of GDP; then it moved to infrastructure and housing, but these are now being cracked down upon. So what’s next?

Growth in China was already challenging, thanks to a peak in working age population and falling capital output ratios. The effect of deleveraging and deemphasizing the residential property sector as an engine of growth could be very dramatic. The developers have total liabilities that are 70% of GDP, so as they deleverage, there will be a heavy knock-on effect to growth in other industries. This will naturally include the construction industry, which has a gross output of 25% of GDP and itself has liabilities of 18% of GDP.

The other potential impact from the travails of Evergrande is on the fiscal accounts. Developers acquire the land they build on by buying the right to build from local authorities, and these land-rights sales are a very important part of funding local governments and domestic infrastructure. Land sales are already falling in China, and are already down 10% this year. But in the last few months, they’ve been reducing at a much faster rate. Land sales could properly collapse and be down 75-80% for a number of years. This burden on local governments will necessitate fiscal reform, for example a property wealth tax, which would in itself have implications for investment and growth.

SO: What could be the impact on the rest of the world from Evergrande?

SP: The impact on the rest of the world - directly from Evergrande, and from the issues around the property sector in general - is potentially very deflationary. The iron ore price has collapsed since mid-July, as China accounts for half the steel usage in the world, and much of that goes into residential property. The prices of other commodities and construction materials will fall as China grows less vigorously.

This deflationary pressure may go someway to counteract the worries expressed over the fact that the rest of the world has been printing money like there’s no tomorrow to cover for the pandemic. Indirectly and directly, property development accounts for about 25% of Chinese GDP, and China has been accounting for a disproportionately large amount of global growth. So a shrinkage of the Chinese economy may lead to non-inflationary growth elsewhere, and the rest of the world potentially gets away with printing money without inflation. This will be particularly the case in countries that are major exporters to China, for instance Australia. This is illustrated in bond markets: the long end of the bond market yields have been falling despite short-term rises in inflation.

Because the property development sector has such an impact on GDP, it could lead to a weakening of the currency because of the issues around decreasing inflation and opportunities. This could lead to capital exodus.

SO: Is this a wakeup call for American and foreign investors in China?

SP: It absolutely is a wake-up call. This comes on top of the crackdown on tech stocks, Macau gaming stocks and education, and is another example of how dual-circulation strategy is investor and capital unfriendly. Given that Xi Jinping is very keen on returning China to its Marxist-Leninist roots, it’s a warning shot for people who believe China is a capital and investor friendly environment.