The Evenstar Institute's Weekly Chinese Influence Bulletin 18 Feb 2023

China woos Europe, Beijing sanctions US firms, Singapore pulls back on China investment

Hello and welcome back to What China Wants.

Below we publish the weekly newsletter of the Evenstar Institute, the parent of What China Wants and a think tank dedicated to measuring and understanding national influence in the 21st century.

ABOUT THE EVENSTAR BULLETIN

The Evenstar Institute's weekly bulletin comprises updates on changing global influence, macro supply chain events, and other China-related news. We will also highlight books, articles, events, and episodes of our podcast, What China Wants.

If you have any questions about the contents of the bulletin or the Institute's research, get in touch via our website.

INFLUENCE UPDATES

Government and Administration

On 15 February, China Foreign Minister Wang Yi met with French President Emmanuel Macron and Foreign Minister Catherine Colonna at the start of his trip to Europe. France is the first stop on Wang’s week-long tour of Europe; he is expected to also travel to Italy, Germany, Hungary, and Russia.

According to a Xinhua report, one of Beijing’s key messages was to urge France against decoupling from China, and to call on Paris to boost tech cooperation and provide a fair environment for Chinese businesses against the backdrop of a chip ban by the United States.

On 16 February, Wang met Italian Deputy Prime Minister and Foreign Minister Antonio Tajani in Rome. The SCMP reported that Wang said China valued Sino-Italian relations and was “ready to deepen comprehensive strategic cooperation”, highlighting existing cooperation with Italy on the Belt and Road Initiative as greatly enhancing bilateral ties.

Wang is expected to deliver a speech at the Munich Security Conference this weekend, before visiting Hungary and Russia.

Singapore’s sovereign wealth fund rethinks China strategy

Finance, Trade, and Investment

Singapore’s sovereign wealth fund GIC has reportedly pulled back from its investments in China. The Financial Times reported on 14 February that the fund, one of the world’s largest investors in private equity funds, has significantly scaled back its commitments to China-focused private equity and venture capital funds over the past year. Furthermore, it has reportedly also slowed the pace of its direct investments in private companies.

Internal GIC sources are corroborated by ITjuzi, a data provider that monitors investments in China, which recorded two direct investments by GIC in Chinese companies in 2022, compared to 16 in 2021. This reduction is also compounded by GIC’s ramp up of overall investment, deploying 17% more than in 2021, according to industry tracker Global SWF.

The fund had been a significant investor in Chinese real estate and holds a stake in Ant Group, whose planned USD 37 billion IPO was halted by Chinese regulators in 2020. The chief explanation offered for this change in attitude has been attributed to the impact of China’s property crisis and Beijing’s crackdown on its own tech companies. One of the internal sources emphasised that the fund was “burnt bad” by the crackdown on Ant and has since become wary of future unexpected moves from Beijing that could hit its investments or its ability to exit them.

China Sanctions US Defence Companies over Taiwan arms sales

Defence and Security

On 16 February Lockheed Martin Corp and Raytheon Missile and Defense Corp, a subsidiary of Raytheon Technologies Corp, were prohibited from “engaging in import and export activities related to China”, and put on an “unreliable entities list”, in a statement from China’s commerce ministry.

In February 2021, China sanctioned the two companies over a USD 100 million arms sale to Taiwan. The latest measures come amid heightened US-China tensions after the U.S. military shot down what it alleges was a Chinese spy balloon on 4 February, and a day after Beijing warned of “countermeasures against relevant U.S. entities that undermine China’s sovereignty and security”.

Neither company presently sells defence products to China. Raytheon Technologies sell its Pratt & Whitney aircraft engines, as well as landing gear and controls, to China’s commercial aviation industry. Karine Jean-Pierre, White House press secretary was quoted as saying that these are “symbolic measures and unnecessary – that’s how we view them.”

DRC demands USD 17 billion more in infrastructure investments from China deal

Finance, Trade, and Investment

On 17 February reports emerged that Democratic Republic of Congo’s state auditor has demanded an additional USD 17 billion of investments from a 2008 infrastructure-for-minerals deal with Chinese investors.

The report comes as President Felix Tshisekedi's government has been revisiting the original 2008 deal struck by his predecessor Joseph Kabila. Under the original deal, Sinohydro Corp and China Railway Group Limited agreed to build roads and hospitals in exchange for a 68% stake in Sicomines, a cobalt and copper joint venture with Congo's state mining company Gecamines.

The Chinese investors had originally committed to spending USD 3 billion on infrastructure projects, but in this new report the state auditor - Inspection Generale des Finances (IGF) – has now demanded that this commitment be increased to USD 20 billion, to reflect the value of the mining concessions that Gecamines contributed to the deal.

According to the report, Sicomines has only spent USD 822 million on infrastructure investments so far. The auditor also called for an "immediate" USD 1 billion investment from Sicomines, and a commitment to 50% of the workforce on infrastructure projects being Congolese.

China’s embassy in Congo has responded by expressing shock at the state auditor’s report, calling it “full of prejudice” and not corresponding to reality.

OTHER NEWS

Sam Olsen on Reaction podcast

Sam joined Lucy Beresford on the Reaction podcast “On the Couch” to give some analysis on China-US relations in the wake of the spy balloon saga. Listen to it here.

The Many “One Chinas”: Multiple Approaches to Taiwan and China

The Carnegie Endowment published a piece addressing the “one China” principle. With increased tensions across the Taiwan straits over the past year we have seen intensified debate over the interpretations of what “one China” means. Beijing consistently asserts that over 180 countries accept its “one China principle” regarding Taiwan, but the reality is in fact more complicated.

In this report, Chong Ja Ian of Carnegie China sets out and explains the nuances and implications of ten classifications of positions on the “one China” issue. Chong also provides a historical context of how these are affected by how a given state assed its relations with the PRC, the US and Taiwan while establishing formal ties with Beijing and as relations developed.

Chong explains the importance of understanding these nuances in position; appreciating the actual range of stances states adopt toward PRC claims over Taiwan can provide a starting point from which to assess statements by predecessors or those of neighbours and partners, as well as to determine any actual shifts in positions.

Epidemiologists suggests COVID-19 may have killed 1-1.5 million people in China

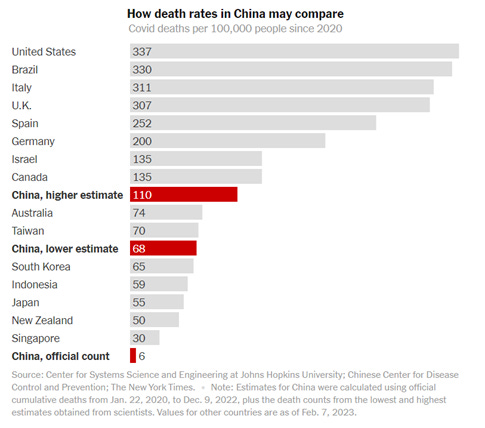

After Beijing relaxed its strict COVID-19 restrictions in December, the virus spread rapidly, but China’s official death toll for the entire pandemic has remained strikingly low at 83,150 people as of 9 February. On 15 February, the New York Times published its findings from its consultations with epidemiologists. While precise accounting is impossible, four separate academic teams have converged on broadly similar estimates: China’s COVID-19 wave may have killed between 1 million and 1.5 million people. All of the consulted researchers cautioned that without reliable data from China, the estimates should be understood as informed guesses, with significant uncertainty.

Two of these estimates were in papers published in academic journals or posted for peer review, while two other analyses were shared by epidemiologists in response to queries from the NYT.

There are multiple reasons why the official death toll has been interpreted as an undercount by researchers. One is that China’s official estimates only includes infected people who died in hospitals, excluding anyone who died at home. Furthermore, officials only announced deaths that involved respiratory failure, leaving out infected people who died of liver, kidney or cardiac failure. Other data is missing, including at least nine cities across China, including Beijing, that have stopped publishing quarterly cremation totals.

The disparity between China’s figures and researchers’ estimates is dramatic. Using official numbers, China has the lowest death rate per capita of any major country over the entirety of the pandemic. But at the estimated levels of mortality, China would already have surpassed official rates of death in many Asian countries that never clamped down as long or as aggressively.

THE PODCAST

A reminder that in this week’s What China Wants podcast (published every Thursday), Sam and Stewart discussed the latest research from the Evenstar Institute, looking at the rise in China’s influence in Southeast Asia.

You can also listen to the podcast on Apple, Amazon, or Spotify.

ABOUT THE EVENSTAR INSTITUTE

The Evenstar Institute is a non-partisan, not-for-profit think tank focused on measuring and understanding the evolving nature of national influence in the twenty first century.

If you would like to support us, please visit the donate page on our website.

It has long been fashionable for critics to impugn the PRC's statistics using epithets like 'dodgy'.

So successful has this 70-year campaign been that China – still distant in our media's rearview mirror – actually passed us miles ago and is disappearing into the future.

After 70 years of Chinese stats and 70 years of our media doubting them, Chinese stats are ahead 100-0.

If you doubt me, find an official Chinese stat that has proven false or misleading.