As we prepare for Christmas here’s something festive to read: the potential for more economic disruption to come. Disruption that could match Covid for its impact on the world.

But first, if you a reading this then thank you, but if you aren’t a subscriber then please do so – just click here and add your email address.

This week we look at whether the US is preparing for full-on financial war with China. Next week, we discuss what on earth China could do about it.

Have a very Merry Christmas.

Sam

***

As the FT reported last week, funding for China’s landmark foreign development programme, the Belt and Road Initiative (BRI), has fallen off a cliff.

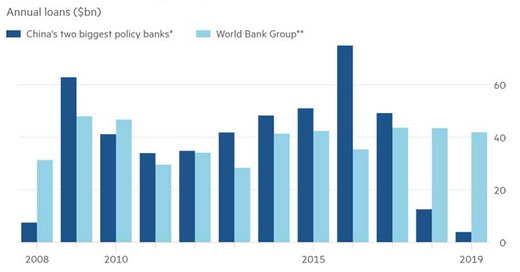

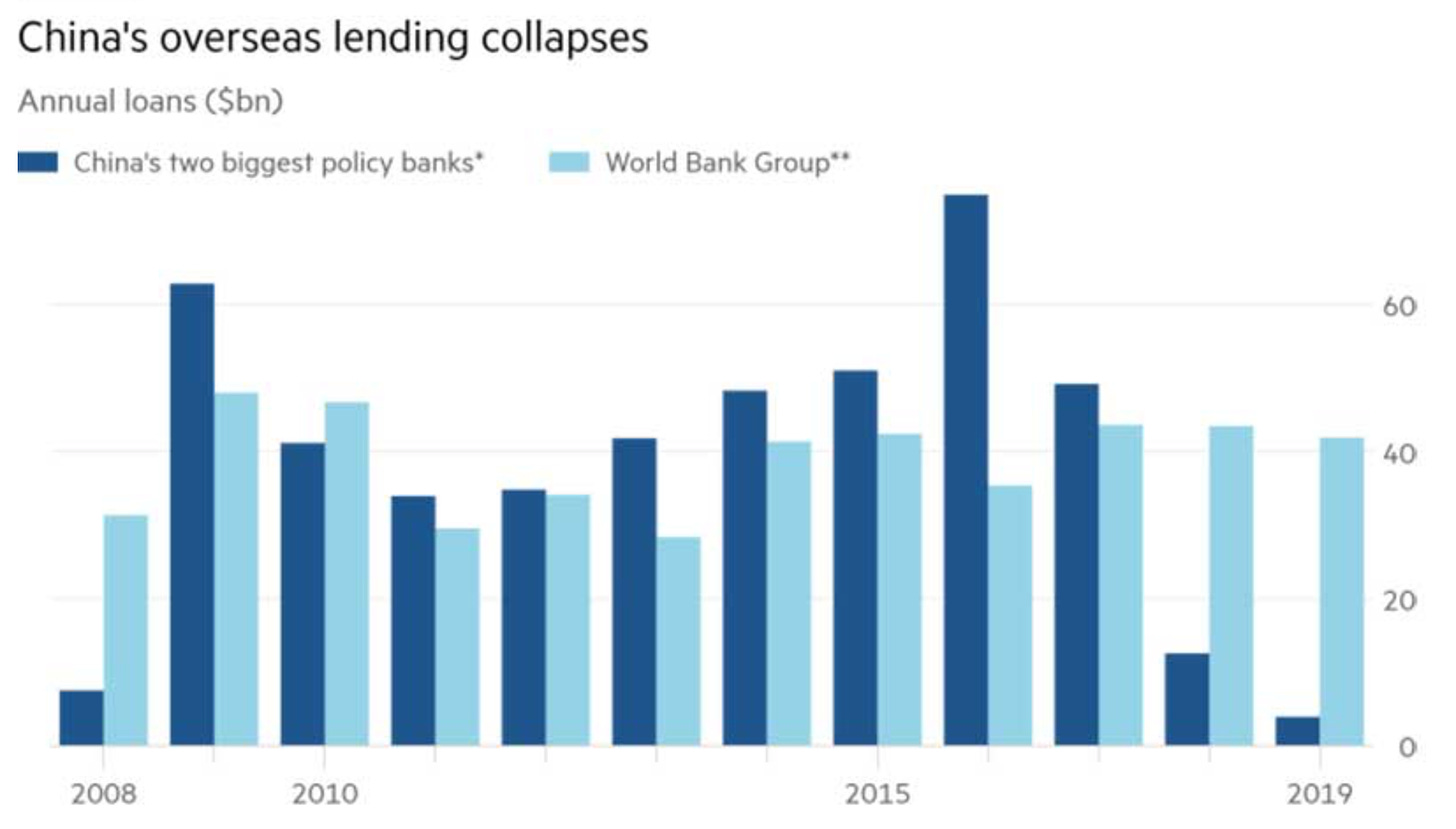

Researchers from Boston University have found that overseas lending by the two state-owned Chinese institutions that provide the overwhelming majority of overseas development lending, the China Development Bank and the Export-Import Bank of China, has collapsed from a peak of $75 billion in 2016 to just $4 billion in 2019.

According to some observers this maybe a sign of China pulling back from the world. There are also concerns the BRI has grown too big, and attracted inefficient capital.

There could however be another reason for this sudden frugality. China may be holding back its foreign reserves to as it prepares for what is becoming a distinct possibility: America ramping up its anti-Chinese actions from a trade war to a full-on financial war.

*China Development Bank & the Export Bank of China; ** International Development Association and International Bank for Reconstruction and Development. Source: Boston University Global Development Policy Center, World Bank, FT

The US Ramping up Pressure on China

America is already in effect withholding dollars from China. On November 12th this year President Trump signed an “Executive Order on Addressing the Threat from Securities Investments that Finance Communist Chinese Military Companies”. Americans were banned from doing any sort of business with a group of named companies suspected of helping the People’s Liberation Army.

More Chinese firms were included in a new list published last Friday. “We will not allow advanced US technology to help build the military of an increasingly belligerent adversary,” said the US Commerce Secretary, Wilbur Ross.

Some of the companies included in this so called “entity list” by America are beginning to be household names, like DJI, the world’s dominant drone maker. Given that China is now the world’s leading military drone manufacturer, targeting the jewel in the country’s drone crown makes sense on one level. But by citing DJI, Washington is making a grand statement that no matter how big and international your company is, we will hurt you.

What is worrying is that the US doesn’t appear to be finished. In fact, there are suspicions that Washington is planning a scaled-up financial war against China, according to Stewart Paterson, the author of China, Trade, and Power, and the Founder of Capital Dialectics, an economic research firm.

“The language used by America to justify the blacklisting can easily be used to justify an escalation in actions taken against China,” says Paterson. He is right, in that the Executive Order expressly points to how hard it is to separate military from civilian in the Chinese economy.

“Key to the development of the PRC’s military, intelligence, and other security apparatuses is the country’s large, ostensibly private economy,” reads the November 12th order. “Through the national strategy of Military-Civil Fusion, the PRC increases the size of the country’s military-industrial complex by compelling civilian Chinese companies to support its military and intelligence activities.”

By using economic support for the PLA as justification to open up economic action against China, the path has been laid for this to develop into total financial warfare. After all, if the PLA is supported by the whole Chinese economy, then the whole Chinese economy is game when it comes to sanctions.

There is also the realisation that the window of opportunity for any US action against China is shrinking. If American wants to preserve its global hegemony then it needs to deliver a blow to China now, before China is able to fully deploy its defences.

China Stepping up Preparations

China is indeed preparing those defences. Many in China’s political and financial elite have been discussing in recent years the potential for a financial war, and what to do if the worst came to pass.

The economist Lou Jiwei is one. Lou has long been seen as an advocate of liberalising China’s economy, and has served both as the country’s finance minister and head of its sovereign wealth fund. In November last year Lou told a panel in Beijing that “The next step in the frictions between China and the United States is a financial war (jinrong zhan). The US has been hijacked by nationalism and populism, so will do everything in its power to use bullying measures [and] long-arm jurisdiction.” In this financial war, he continued, the US will exploit its dominance of the international financial system to hurt China. It is thus vital that China quickly beefs up “its financial independence and sovereignty”, said Zhou Yu, director of international finance research at the government-run Shanghai Academy of Social Sciences.

One increasingly important strand to China’s broader economic defences is the Dual-Circulation strategy, which was first mentioned in May this year. In essence Dual-Circulation is a way of weaning the country off the export-led growth that has propelled China from economic basket case forty years ago into the world’s second largest economy. This success has, however, left the country vulnerable to foreign (i.e. American) pressures.

China wants to weaken this dependence on America by using the massive potential of its domestic economy as an engine of growth – the first circulation. The second circulation is foreign trade, but this is a deeper, more calculated relationship with friendly foreign economies, one that is absolutely set up to benefit the Chinese domestic economy and reduce its risks.

In many ways this is setting China up to be almost like an autarky+. President Trump has shown how the People’s Republic is vulnerable to American sanctions. For example, Huawei is already under heavy US sanctions, but only a minority of the components in a Huawei smartphone are made in China or even in Chinese-friendly countries. Such is the threat to China’s electronics industry from being cut off from US-linked components that Xi Jinping has pledged $1.4 trillion over the next five years to develop China’s domestic electronics industry, especially around all-important semiconductors.

In the words of James Crabtree, Dual-Circulation “is a darkly pessimistic economic strategy, fit for a new Cold War”, one that envisages China being cut off from much of the international supply chain at some point in the not too distant future.

Hello Dollar Blockade

A decoupling of some supply chains through the full adoption of Dual Circulation would be painful, but it would be nowhere near what could be expected from a full financial war via a dollar blockade, i.e. a total ban on all financial dealings with Chinese companies. This could be just for US citizens, or, more aggressively, threatening action against any country, institution, or individual anywhere in the world that dared to deal with the Chinese.

There is no doubt that the declaration of such a financial war would hurt China. China needs dollars for a variety of reasons, including paying for the energy and food it imports. Oil spend alone in 2019 was approximately $160 bn, and the total for food in the same year was $105 bn. It also has foreign debt of around $2tn in a mixture of currencies, but of course including dollars.

Dollars are also needed to provide hard currency backing to the RMB money supply through reserves, something which the plutocratic class of Chinese investors have a strong preference for when there is no other backing for the yuan other than the reputation of the Chinese Communist Party.

American dollars are also needed to finance China’s economic expansionism, including through the BRI. As Paterson notes, the best way for the United States and its allies to restrict Chinese expansionism is to deny them access to dollars.

Any immediate pain from a dollar blockade would be cushioned by the $3.1 trillion of foreign reserves that China holds. Nonetheless, these wouldn’t last for ever, and it would be a dangerous risk for China not to take immediate action to stem any damage from America’s declaration. A reduction in BRI spend would be only the tip of the iceberg.

We will look at what China could do, and the ramifications for external investors, next week.

In the meantime – have a very Happy Christmas.